portability estate tax return

The second thing that the legislation made permanent was the portability of estate tax. Portability is the right of an executor to transfer or port the unused estate tax exemption from the first spouse to die to the second spouse to die.

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

What Does Portability of the Estate Tax Exemption Mean.

. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate tax for 2021. Portability enables the surviving partner to transfer the Deceased Spouse Unused Exempt Amount DSUEA to the surviving partner. Calculating the DSUE is simple.

This term refers to the ability to transfer that unused portion to the surviving spouse referred to as the deceased spouses unused exemption DSUE. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of. Thanks to portability the surviving spouse can use the deceased spouses unused estate tax exemption and add it to their own when the surviving spouse passes away.

Portability occurs when a surviving spouse files an estate tax return for the purpose of calculating and capturing any Estate Tax credit left unused in the estate of the first spouse to die. This is done so the portability election can be made on time via a federal estate tax return. If you dont file the 706 at the first death you cannot elect to port over this remaining amount.

Depending on the size of the estate you may wish to take advantage of estate tax portability which allows a spouse to assume the tax exemption of their deceased spouse on top of their own. Portability is a federal exemption. Portability is a federal exemption.

It is transferred to the surviving spouse to reduce the overall estate tax once the second spouse passes away. This is called the deceased spouses unused exemption or DSUE. A portability election made by a non-appointed executor when there is no appointed executor for that decedents estate can be superseded by a subsequent contrary election made by an appointed executor of that same decedents estate on an estate tax return filed on or before the due date of the return including extensions actually granted.

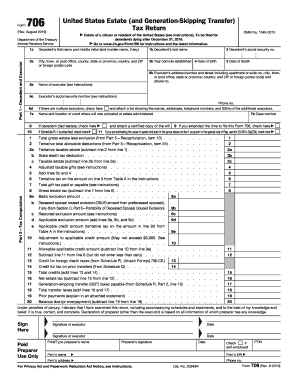

Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such return. When filing Form 706 the tax return assumes that you elect Portability. If you choose to opt-out you must choose to do so on page 4 Part 6 Section A.

The term election here means a decision made by checking a box on a tax return. The due date of the estate tax return is nine months after the decedents date of death however the. This portability election increases the total exclusion available to the surviving spouse by the amount of the deceased spouses unused exclusion.

The good news is that a surviving spouse does not have to file Form 706 when the estates gross value which includes prior taxable gifts is less than the basic exclusion amount. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can make the right decision of whether or not to make. This transfer is accomplished by completing the election on the Form 706 Estate Tax Return and can be completed without regard to the legal ownership of each spouse.

Another concept needs to be understood as well portability. Formally this is called the Deceased Spouse Unused Election DSUE. The due date of the estate tax return is nine months after the decedents date of death however.

However when one spouse dies the surviving spouse is encouraged to file a Federal Estate Tax return for reasons of portability. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the. Estate tax return preparers who prepare a return or claim for refund which reflects.

A Bit of Background. If IRS Form 706 is filed in a timely manner the. Estate tax portability can be a useful tool for couples who are creating estate plans and have a lot of assets between them and is something to be mindful of when youre estate.

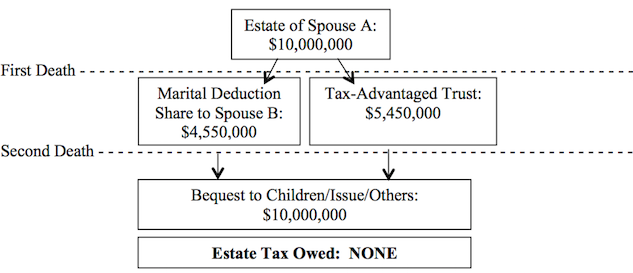

The Impact of the Portability of the Federal Estate Tax Exclusion Example 1. In order to elect portability a surviving spouse must file an estate tax return Form 706 for the federal estate tax and Form MET-1 for the Maryland estate tax. Estate tax portability can be a useful tool for couples who are creating estate plans and have a lot of assets between them and is something to be mindful of when youre estate.

Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. To secure these benefits however the deceased spouses.

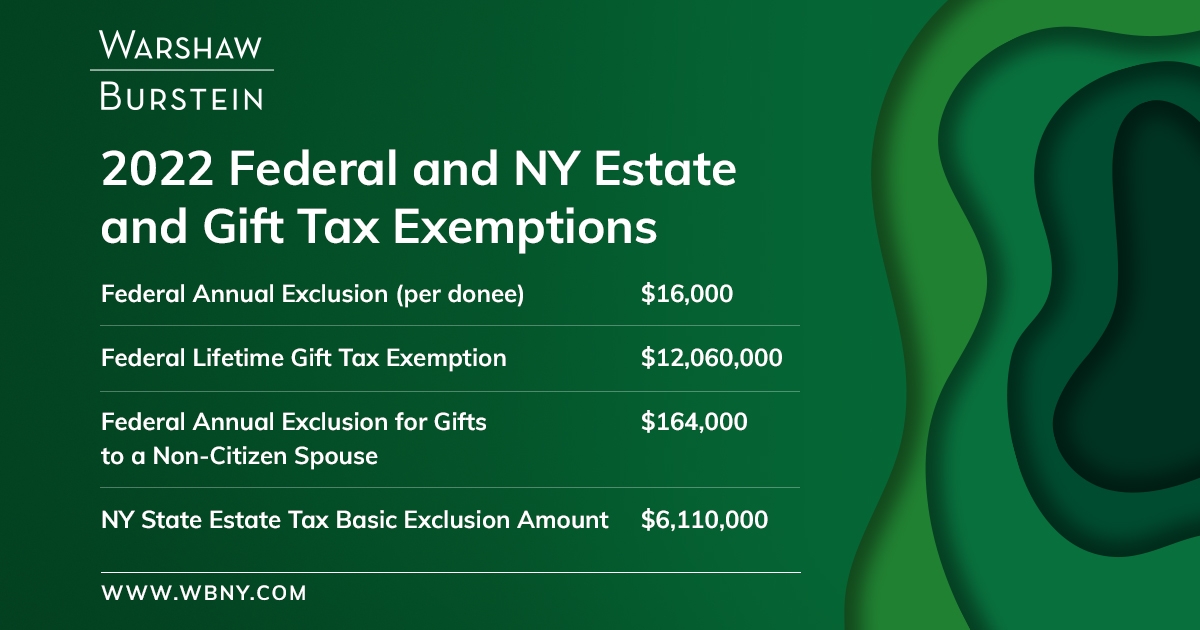

For 2020 the exemption amount is 1158 million and the IRS just announced that that amount will increase to 117 million for 2021. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months.

A portability election made by a non-appointed executor when there is no appointed executor for that decedents estate can be superseded by a subsequent contrary election made by an appointed executor of that same decedents estate on an estate tax return filed on or before the due date of the return including extensions actually granted. The temporary portability regulations require every estate electing portability to file an estate tax return within nine 9 months of the decedents date of death unless an extension of time for. In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely.

This is because when a spouse passes away they use a portion of the Federal Estate Tax exemption but theres usually a portion available for the surviving spouse.

Federal Estate Tax Return Irs Form 706

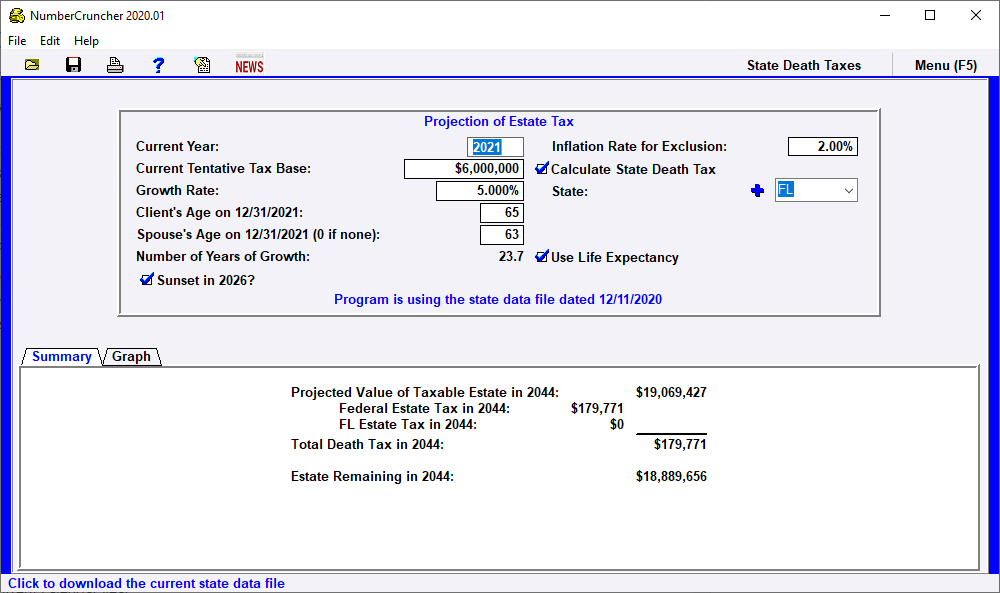

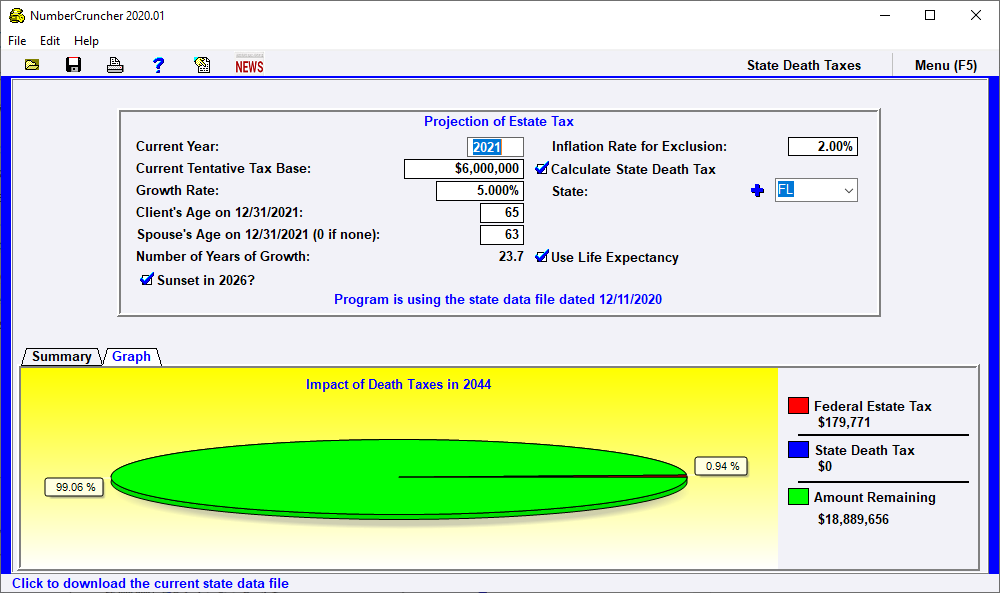

Project Projection Of Estate Tax Leimberg Leclair Lackner Inc

Generation Skipping Transfer Trusts Dynasty Trusts Lenox Advisors

Final Regulations Confirm No Estate Tax Clawback Center For Agricultural Law And Taxation

A Trust May Be Taxed As Either A Grantor Trust Or A Nongrantor Trust Each Type Of Trust Has Advantages And Disadvanta Estate Tax Estate Planning Grantor Trust

Tips For Filing Taxes When Married Rings Married Married Couple

Virginia Estate Tax Everything You Need To Know Smartasset

Form 706 Fill Out And Sign Printable Pdf Template Signnow

Georgia Estate Tax Everything You Need To Know Smartasset

Project Projection Of Estate Tax Leimberg Leclair Lackner Inc

2020 Estate Planning Update Helsell Fetterman

Warshaw Burstein Llp 2022 Trust And Estates Updates

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Estate Tax Panning For Married Couples Using Estate Tax Exemptions

What Does Portability Mean And How Do I Use It Legacy Design Strategies An Estate And Business Planning Law Firm

This Is Another In A Series Of Blogs On The Basics Of Estate Planning Estate Planning Attorneys Do Estate Planning Estate Planning Attorney Law Firm Marketing

Should You Elect The Alternate Valuation Date For Estate Tax

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break